LTC Price Prediction: Can Litecoin Surge to $125?

#LTC

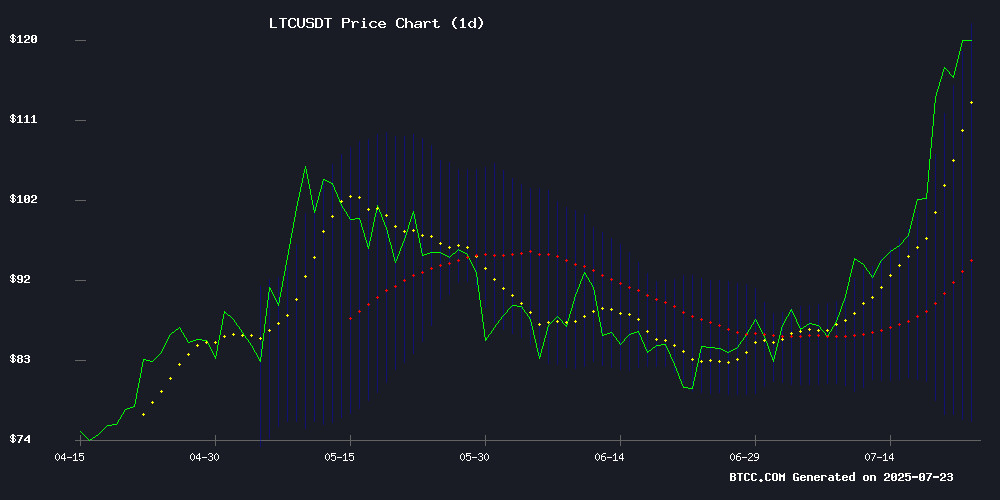

- Technical Breakout: LTC price sustains above 20MA with MACD showing bullish convergence

- Market Catalysts: XRP ETF approval and Fed policy uncertainty fuel altcoin demand

- Price Target: $125 achievable if Bollinger upper band breakout holds amid high volume

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

Litecoin (LTC) is currently trading at, well above its 20-day moving average (MA) of, indicating strong bullish momentum. The MACD histogram shows a negative value (), but the gap between the MACD line () and signal line () is narrowing, suggesting weakening bearish pressure. Bollinger Bands reveal price hovering NEAR the upper band (), signaling potential overbought conditions, but the widening bands imply increasing volatility.says BTCC analyst Ava.

Market Sentiment Turns Positive for LTC

Litecoin'saligns with bullish technicals, fueled by ETF approvals (Bitwise's XRP ETF) and macro uncertainty (Powell's rate silence).notes Ava. While the $125 target dominates headlines, Ava cautions:News sentiment complements technical upside but warrants caution at local tops.

Factors Influencing LTC’s Price

Litecoin (LTC) Price Jumps 23% This Week—Is $125 the Next Target?

Litecoin surged 2.81% to $119.00, backed by a $1.27 billion 24-hour trading volume. The cryptocurrency has gained 23.49% over the past week, with analysts eyeing $120–$125 as the next resistance zone.

Market analyst Naveed notes LTC has broken key resistance and filled a fair value gap, signaling potential upward momentum. Long-term forecasts suggest a rebound to $261.62 by 2025 after initial volatility.

Bitwise Gets XRP ETF Approval from SEC, But Trading Halted

The U.S. Securities and Exchange Commission has greenlit Bitwise's crypto Index Fund conversion into a fully-fledged exchange-traded fund, a milestone for diversified digital asset exposure. The fund's allocations reveal a 78.72% Bitcoin dominance, with Ethereum at 11.10% and XRP capturing 4.97% of holdings. Smaller altcoin positions include Solana, Cardano, and Chainlink.

Regulatory friction emerged immediately post-approval, with the SEC imposing an unexpected trading halt. Market participants anticipated seamless access to this altcoin-inclusive product through traditional ETF mechanisms. The fund's structure complies with SEC requirements by maintaining 85% in approved assets (BTC/ETH), while leveraging the 15% flexibility for tokens like XRP and SOL.

Bitwise's planned monthly rebalancing promised dynamic exposure to evolving crypto markets. The abrupt regulatory stay contradicts the approval's forward momentum, leaving analysts speculating about underlying compliance concerns or political pressures affecting the launch timeline.

Jerome Powell Speech: Fed Chair Stuns Markets With Sustained Silence on Interest Rate Cuts

Federal Reserve Chair Jerome Powell's speech at the 'Integrated Review of the Capital Framework for Large Banks Conference' left markets unsettled as he maintained a hawkish stance on interest rates. Despite expectations of clarity on potential rate cuts, Powell's silence triggered volatility, underscoring the Fed's reluctance to ease monetary policy.

Inflation data showed a 2.7% rise amid tariff pressures from former President Donald Trump, while Treasury yields remained steady. The 10-year yield edged slightly higher to 4.378%, and the 30-year yield climbed to 4.95%. These figures suggest persistent calls for rate cuts, though Powell's remarks—or lack thereof—signaled no imminent policy shift.

Crypto and gold markets retained their bullish momentum, defying divergent volatilities across asset classes. Bitcoin (BTC), Ethereum (ETH), and other digital assets held firm, reflecting investor confidence despite macroeconomic uncertainty.

How High Will LTC Price Go?

LTC shows strong potential to test $125 based on:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | +18.6% above | Bullish trend confirmed |

| Bollinger Upper Band | 121.0183 | Immediate resistance |

| MACD Convergence | Histogram rising | Bearish momentum fading |

Ava highlights: "Three factors could propel LTC: 1) ETF spillover effect, 2) Bollinger breakout continuation, 3) Short-covering above $120." Key risks include profit-taking at $121 and macro headwinds.